Debt Relief Strategies: Effective Plans for Everyone

Debt can feel overwhelming. Many people struggle with managing their financial obligations. But there are solutions available.

Debt relief strategies offer a way to regain control. They can help reduce stress and improve financial health. Understanding these strategies is crucial.

There are various types of debt relief. Each has its own benefits and drawbacks. Choosing the right one depends on individual circumstances.

Creating a debt reduction plan is a vital step. It involves assessing your financial situation and setting realistic goals. This plan acts as a roadmap.

Budgeting is the foundation of any debt relief strategy. It helps track income and expenses. Effective budgeting can accelerate debt reduction.

Professional help is also available. Credit counseling and debt management plans offer guidance. They can provide personalized advice and support.

Avoiding scams is important. Not all debt relief services are legitimate. Research and caution are necessary.

With commitment and discipline, debt relief is achievable. It can lead to a more secure financial future.

Summary

This guide explains how to regain control over debt through tailored strategies such as consolidation, credit counseling/DMPs, settlement, and bankruptcy, along with payoff methods like the snowball and avalanche. It emphasizes building a realistic debt reduction plan and disciplined budget, understanding debt types and impacts, and leveraging reputable professional help and tools. You’ll learn to weigh trade-offs, avoid scams, and adopt long-term habits—emergency savings, spending controls, and regular reviews—to stay on track toward financial freedom.

Understanding Debt and Its Impact

Debt can significantly affect everyday life. It often leads to financial stress and anxiety. Yet, understanding its impact is essential for managing it.

Debt influences credit scores, which affects borrowing ability. A lower credit score can lead to higher interest rates. This makes debt more costly over time.

It can also limit future financial opportunities. High debt levels can hinder saving for retirement or other goals. It affects financial independence and stability.

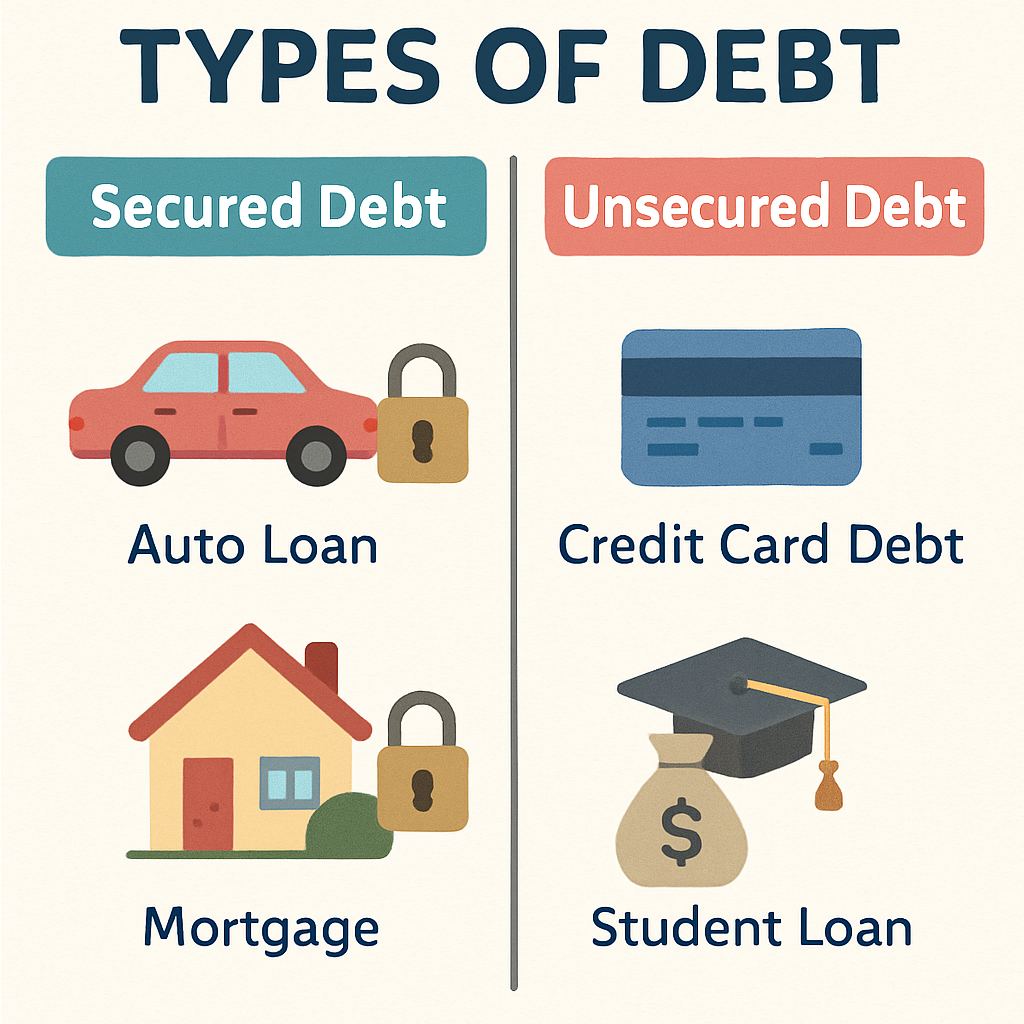

Understanding the types of debts is important. Common categories include:

Secured Debt: Backed by collateral.

Unsecured Debt: No collateral; includes credit cards.

Revolving Debt: Allows continuous borrowing up to a limit.

Installment Debt: Regular payments over a set period.

Debt doesn't just affect finances; it impacts emotional well-being too. Stress from debt can affect health and relationships. Recognizing these impacts encourages proactive solutions.

It's crucial to approach debt with a comprehensive view. By understanding it fully, people can form effective strategies. This helps regain control and work towards financial goals.

Types of Debt Relief: An Overview

Debt relief comes in many forms, each with unique benefits. Understanding these options helps in selecting the best approach.

Debt Consolidation is a popular method. It involves merging multiple debts into one loan. This often comes with a lower interest rate, simplifying payments.

Credit Counseling offers professional guidance. These services provide advice on managing debt. They may also help create a debt management plan.

Another option is Debt Settlement. This involves negotiating with creditors to reduce the amount owed. It can significantly decrease overall debt.

Bankruptcy is a legal option for debt relief. While it can discharge certain debts, it has long-lasting effects on credit. It should be considered as a final alternative.

Government Programs can also provide relief. These initiatives offer support through various financial aid programs. They assist with managing and reducing debt effectively.

Common debt relief types include:

Debt Consolidation: Merge debts for simplicity.

Credit Counseling: Professional help and planning.

Debt Settlement: Negotiate for debt reduction.

Bankruptcy: Legal option with lasting effects.

Choosing the right strategy depends on personal financial situations. It's vital to weigh the pros and cons of each. Tailored strategies can lead to effective debt management and relief. Understanding these types equips individuals to tackle debt with confidence.

Creating Your Debt Reduction Plan

Crafting a personalized debt reduction plan is a crucial step in achieving financial freedom. It begins with assessing your current financial situation.

Understanding your total debt load is key. Create a detailed list of all debts. Include interest rates and minimum payments.

Next, set realistic and achievable financial goals. Decide how quickly you want to eliminate your debt. Determine how much money can be allocated monthly to debt payments.

Develop a strategy based on your financial analysis. Consider prioritizing high-interest debts first. Alternatively, focus on smaller balances for quick wins.

Key components of a debt reduction plan:

List all debts: Include interest rates and balances.

Set financial goals: Specify timelines and amounts.

Prioritize debts: Choose high-interest or low-balance.

Allocate extra funds: Use additional income for payments.

Monitor progress: Regularly review and adjust the plan.

Regular review and adjustment of your plan are essential. This keeps you on track and motivated. Stay flexible and adapt to changing circumstances.

by FIN (https://unsplash.com/@fin21)

By implementing this structured approach, financial stability becomes achievable. The initial effort in creating a well-thought-out plan is an investment in a brighter financial future.

Budgeting: The Foundation of Debt Relief

Budgeting serves as the cornerstone of any effective debt relief strategy. It helps track income and expenses, providing a clear picture of your financial situation.

Creating a budget begins with listing all income sources. Include regular wages, side earnings, and any other revenue streams. This provides a comprehensive view of your financial capacity.

Next, document all monthly expenses. Categorize them into essential and non-essential. Essentials typically include housing, utilities, and groceries.

A budget allows you to identify areas where you can cut back. Redirect those savings toward debt payments. Even small savings can make a big difference over time.

Here's a simple budget outline:

Income: List wages and other earnings.

Essential expenses: Include rent, utilities, food.

Non-essential expenses: Entertainment, dining out.

Savings and debt payments: Allocate remaining funds.

Monitoring your budget regularly ensures you remain on track. Adjust as needed to accommodate changes in income or expenses.

by Kelly Sikkema (https://unsplash.com/@kellysikkema)

A well-maintained budget fosters disciplined spending habits. This foundational step can greatly expedite achieving debt-free living. Embrace the power of budgeting and transform your financial landscape.

Popular Debt Relief Strategies Explained

Several strategies can effectively alleviate debt burdens. Each offers unique advantages tailored to different financial circumstances.

Debt consolidation simplifies payments by combining multiple debts. It often involves a new loan with a lower interest rate. This can reduce financial strain and make repayments more manageable.

Credit counseling provides expert advice. Counselors help create a debt management plan, focusing on budgeting and disciplined spending.

Debt settlement negotiates with creditors to reduce owed amounts. It can save money but might impact credit scores. Therefore, considering professional guidance is advisable.

Bankruptcy serves as a last resort. It discharges certain debts but comes with significant long-term consequences. Understanding its implications is crucial before proceeding.

Here's a quick comparison of debt relief strategies:

Debt consolidation: Combines debts with lower interest.

Credit counseling: Offers budgeting support and planning.

Debt settlement: Negotiates debt reduction.

Bankruptcy: Provides debt discharge as a last resort.

Selecting the right strategy involves weighing personal circumstances and financial goals. Debt relief is not one-size-fits-all. Tailoring a plan to fit individual needs maximizes success.

Consulting with experts can provide personalized insights. They can help navigate complex decisions and choose suitable options.

by Morgan Housel (https://unsplash.com/@morganhousel)

Commitment and consistency are key to executing any strategy. Adopting lifestyle adjustments and sticking to a plan can lead to financial freedom over time.

The Debt Snowball Method

The debt snowball method focuses on paying off the smallest debt first. This creates momentum and encourages continued progress.

Start by listing debts from smallest to largest. Pay minimum amounts on all except the smallest. Direct extra funds to this debt until cleared.

Here's how it works:

List debts by size.

Pay the minimum on all debts, except the smallest.

Direct any extra money towards the smallest debt.

Once the smallest debt is paid, move to the next. This method boosts confidence and motivation as smaller debts vanish.

The Debt Avalanche Method

The debt avalanche method targets the highest interest rate debt first. This approach minimizes interest costs over time.

List your debts with interest rates. Pay the minimum on all except the one with the highest rate. Focus all extra payment on this debt.

Steps involved in this method:

List debts by interest rate.

Pay minimums on lower interest debts.

Direct extra payments to the highest interest rate debt.

While progress may seem slow at first, long-term savings on interest can be substantial. Consistently applying the avalanche method reduces overall debt cost effectively.

Professional Help: Credit Counseling and Debt Management Plans

Credit counseling offers guidance from experts dedicated to financial health. These professionals provide insights into budgeting and debt management, paving the path to financial stability.

A debt management plan (DMP) is a structured repayment plan. With a counselor's assistance, monthly payments can be simplified, and interest rates potentially lowered. This plan can help regain control of finances systematically.

Choosing a reputable credit counseling agency is vital. Look for organizations accredited by national associations to ensure quality service. Research and customer reviews can also inform your decision.

Here are key services credit counselors offer:

Budget analysis and creation

Personalized debt management plans

Negotiations with creditors

by Van Tay Media (https://unsplash.com/@vantaymedia)

Engaging a credit counseling service means committing to a clear, disciplined strategy. With professional support, individuals can navigate debt challenges and work towards financial freedom. This support network empowers informed decision-making and focuses on long-term financial health.

Debt Settlement and Negotiation

Debt settlement involves negotiating with creditors to reduce the total debt owed. This strategy can provide significant relief if successful, but it also carries risks and consequences.

Typically, individuals or debt settlement companies negotiate for a lump-sum payment that's less than the total debt. This process can lead to a reduced balance, making it more manageable to pay off. However, it's important to note that creditors may not always agree to settle.

When considering debt settlement, keep these points in mind:

It could impact your credit score negatively.

It's crucial to have funds ready for the settlement offer.

There might be tax implications on forgiven debt amounts.

by LSE Library (https://unsplash.com/@londonschoolofeconomics)

Debt negotiation requires careful planning and consideration. By understanding the potential risks and rewards, individuals can make informed decisions about pursuing this debt relief option.

Bankruptcy: Last Resort Debt Relief

Bankruptcy is often considered the last resort for debt relief. It involves a legal process where certain debts can be discharged. This option can offer a fresh start but has long-term consequences.

The impact on one's credit score is significant and can last for several years. It's essential to understand the types of bankruptcy---Chapter 7 and Chapter 13---that might apply based on financial situations.

Key considerations for bankruptcy include:

Severe impact on credit score and future credit options.

Legal and filing fees involved.

Potential loss of assets.

Bankruptcy should be approached with caution. Consulting with a financial advisor or attorney can provide clarity on whether this is the right option.

Staying on Track: Tips for Long-Term Success

Maintaining financial health requires discipline and consistency. Commitment to a debt reduction plan can make a significant difference over time. Regularly reviewing your progress keeps you aligned with your goals.

It's crucial to monitor spending to prevent accumulating new debts. Cutting unnecessary expenses frees up more money to pay down existing debt. Make use of budgeting apps to easily track expenses.

Building emergency savings is vital to cover unforeseen costs and avoid more debt. Consistency in saving can provide peace of mind. Even small contributions add up over time.

Effective tips for staying on track include:

Regularly review and adjust your budget.

Communicate with creditors to negotiate better terms.

Celebrate small wins to stay motivated.

by Sylvain Mauroux (https://unsplash.com/@alpifree)

Celebrate each milestone achieved. Remember, debt relief is a marathon, not a sprint. Consistent efforts lead to long-term success and financial freedom.

Avoiding Debt Relief Scams and Pitfalls

Navigating debt relief options can be tricky, with scams lurking. Protect yourself by staying informed. Knowledge is your best defense against fraudulent schemes.

Be wary of promises that sound too good to be true. Legitimate services don't require hefty upfront fees. Always research thoroughly before committing to any service.

Red flags to watch out for include:

Guarantees of quick debt elimination.

Pressure to pay fees immediately.

Lack of clear written agreements.

by Connor Pope (https://unsplash.com/@connorpopephotos)

Trust your instincts and verify claims. Legitimate debt relief is a careful and thoughtful process. Take your time and choose wisely.

Resources and Tools for Managing Debt

There are numerous resources available to help manage debt effectively. These tools can simplify tracking expenses and planning payments. Utilizing them can make a significant difference in your debt journey.

Online calculators, budgeting apps, and financial books can be extremely helpful. They offer guidance and structure. Many tools are free or very affordable, making them accessible for everyone.

Consider using:

Budgeting apps for tracking daily expenses.

Debt calculators to estimate payoff timelines.

Financial blogs and podcasts for expert advice.

These resources foster financial literacy and encourage better habits. Explore various options to find what suits your needs best. Adjust your tools as your financial situation evolves.

Conclusion: Taking Control of Your Financial Future

Taking charge of your finances requires patience and persistence. Implementing effective debt relief strategies can lead to a secure financial future.

With the right approach, you can alleviate stress and build confidence. Remember, consistent effort and smart planning are key. Stay committed to your goals for long-term success.